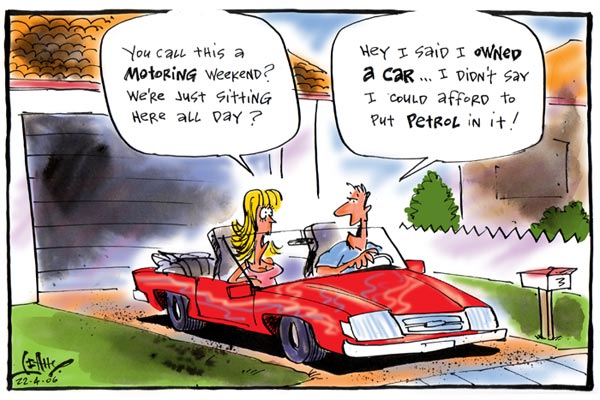

It's time for investors, shareholders and potential homeowners to start separating the morons and criminals of financial institutions who promoted worthless garbage like "SIVs", "CDOs", and "ABCPs".

In a game of hot potato, banks unloaded this junk far and wide in bundles stamped with triple-A creditworthiness stickers, the recipients raking off their fees only to flip the package again until a $475,000 split-level in suburban Toledo whose low-income subprime mortgagee could no longer make the payments had found its way into the portfolio of a municipal employees pension plan in Hamburg or, remarkably, enough, an agency of the Ontario Treasurer.

Now every banker and financial hotdog isn't like former Citibank CEO, Charles Prince and not every financial institution is like "Bear Stearns".

Take for example Toronto Dominion Bank CEO, Ed Clark. About two years ago, he stumbled across an operation within his bank engaged in trading this unfamiliar exotica.

On discovering that the junior-ranking staff playing with the new toys could not explain how they worked, Clark demanded the stuff be immediately dumped (near the top of the market, as good luck would have it).

It should be noted that the TD bank is doing business in the U.S. as TD Banknorth.

Also, U.S. bank JP Morgan had a very good IPO offering of its VISA division.

As for the financial group, after months of weakness, that sector advanced last week after three big U.S. investment banks -- Lehman Bros., Morgan Stanley and Goldman Sachs -- delivered better-than-expected earnings, after the U.S. Federal Reserve backed up JPMorgan Chase's bargain-basement pickup of Bear Stearns.

Also, Bank of Montreal restructured the troubled Apex and Sitka commercial paper trusts, a move that insulates BMO from hundreds of millions of dollars in potential further writedowns connected to the trusts, as well as from possible litigation.

There are many banks who have not weathered this financial crisis as well as the ones above. There are many investment and mortgage people who will lose there jobs over bad loans and bad paper. Hopefully, you'll get someone at your local bank who is selling value at a bargain price rather than hot air.

St Johns

St Johns