Today Is Thanksgiving Day In Canada

There is much that we can give thanks for in Canada. To begin with, We have plenty of natural resources and commodities like wheat and soybeans. It's more than we need for ourselves.

Canadians generally are tolerant of other cultures and religions. We have a federal policy on "Muliticulturalism" that other countries don't have.

We have a good system of public and private health care that seems to get the job done cost effectively.

Canadian banks are number one in the world ahead of Denmark, Sweden, and Luxembourg.

We have lots of lakes and forests in Ontario. The rural countryside is usually less than a half hour drive away from any city.

It's a real pleasure to see the trees turn colours in autumn.

On a personal level, I was lucky to have most of my savings in cash when the stockmarket meltdown occurred.

I'm in good health and I'm looking forward to a company pension in the New Year.

I, also, have a van that's paid for and I have more than half of my mortgage paid down.

My wife and I aren't well off, but we're getting by ok.

My Tripod blog is up and running again.

I've won over $200 hundred at poker last month.

I'm still fighting for a worldwide market recovery and justice in the financial sector. Please go through the entries on this page and the links on the right.

We have an election both here and in the U.S. Hopefully, stiff new brooms will sweep away financial corruption and their perpetrators.

Posted by qualteam

at 11:10 AM EDT

Updated: Monday, 13 October 2008 11:19 AM EDT

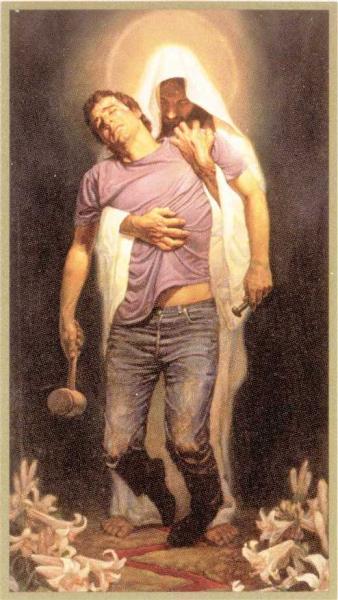

St Johns

St Johns