Music Playlist at MixPod.com

- Turn Your Radio On/Ray Stevens

- Keep On The Sunnyside/Alison Klaus

- Some Kind Of Wonderful/The Drifters

| « | November 2008 | » | ||||

| S | M | T | W | T | F | S |

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | ||||||

Ok, it's been a tough October for the world's stockmarkets. Generally, stocks fell about 30% in the U.S. and Canada, but there's been a 14% comeback over the last few days.

Myself and millions of other investors took big haircuts on our mutual funds and stocks during this month. Pension plans suffered. The poor suffered and Wall Street bankers still want big bonuses.

We don't like any of these situations.

After a night of tricking and treating, our dead investor friends above will be back on the job keeping their eyes on the speculators and the Wall Street gurus.

One of the biggest challenges in this world is to overcome the negative and destructive thinking of those who want us to roll over and die.

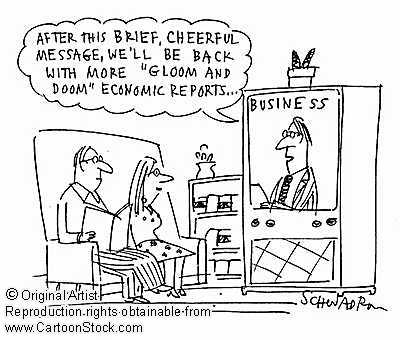

The purveyors of doom/gloom may rationalize their behaviour as "just getting people to face reality", but who created that reality in the first place and why do we have to be stuck in it for a long, long time?

These people are very active during war, crisis or threats of imminent destruction. Growing up in the 1950s and 60s, I realized how dedicated they were to spreading the gospel of nuclear destruction with or without religious dogma. To them, we were all simply pawns in the hands of some uncaring force that could smash anyone at anytime.

Today, most of these doom and gloomers seem to have become economists reading out of the same "economic bible". They postulate that governments and individuals are under the spell of mysterious powers or influences that no one can understand or control.

The predictions of these dark prophets are the buidling blocks of Hell itself:

Everyday, we can hear these fortunate tellers spew their dark visions on financial TV shows.

Needless to say, economic problems bring out the best in some individuals and the worst in others.

We don't have to live in the straitjacket of yesterday's mistakes.

Economists and wealthy capitalists have lost millions in the panic of October 2008. They were/are depressed by their losses. Misery loves company.

For most of us, it's great to have bargains in stocks, housing and gasoline again. Lower prices stimulate demand and what does that lead to.....losses for the doom and gloomers.

I own some mutual funds from a few years ago. I also bought some stocks recently which was a mistake. The markets are very volatile which indicates to me that a bottom hasn't been found with this bear market.

The VIX (Voatility Index) hit an all-time intraday high of 81 two Thursday's ago before closing at nearly 68 that day, and hitting a record close of 70 on the day after. As the Dow Jones industrial average rose more than 400 points last Monday, the VIX fell, closing at about 53. It remained at 53 at last Tuesday's close, after the Dow fell 231 points.

The same thing happened today on the Dow with a swing of over 200 points up and down.

It's highly likely hedge funds and companies are still liquidating their losses for 2008. If you can't get money from a bank, you can get money from your blue chip stocks.

When the bottom is reached, there won't be much action on the Dow or TSX for weeks or even months. Investors need to stabilize and reformulate their investing plans for the near and distant future.

Those who have money will spend it wisely.

What I'm talking about is junk paper like ABCPs, CDOs and Credit Default Swaps. Those products would have normally been sold to collection agencies as bad debts. However, they were misrepresented as low risk securities and sold to other financial institutions for a good commission.

The FBI is busy investigating bankrupt Lehman Brothers to find out who were the main instigators of the biggest investment fraud in U.S. history.

Shall we go over again some of the big names involved in the subprime financial crisis. They are listed in a blog entry below: Stanley O'Neal, former CEO of Merril Lynch, Charles Prince former CEO of Citigroup, Richard Syron, former CEO of Freddie Mac, James Cayne, former Bear Stearns CEO, Fannie Mae former CEO, Daniel Mudd, former Lehman Bros. CEO, Richard Fuld, Wachovia CEO, Ken Thompson, AIG CEO, Martin Sullivan.

Remember those names when you look at your retirement savings plan or loan application.

Merrill Lynch and Citigroup have already been fined for their participation in this scam. The paper trail of the individuals behind this debacle have to be exposed to the public.

On Monday and Tuesday this week, the stockmarket sheep rushed into the TSX and the Dow (900 points up). Just as fast on Wednesday, they rushed out(700 points down).

Conditions of the market didn't change in a day, but the psychology changed. Feelings of greed were suddenly replaced by feelings of fear.

This simply tells me that speculators are still trying to crap shoot the stockmarket either up or down.

I don't do the above, because I want to be a winner in this game.

Investing isn't a game for the mentally and emotionally challenged. Like a chess match, it requires some skill to get into a winning positon.

Personally, I use my gambling tendencies for casinos games and the lottery.

When you bet on decent blue stocks at a cheap price, the odds will be in your favour.

Follow the smart not the stupid money.

There is much that we can give thanks for in Canada. To begin with, We have plenty of natural resources and commodities like wheat and soybeans. It's more than we need for ourselves.

Canadians generally are tolerant of other cultures and religions. We have a federal policy on "Muliticulturalism" that other countries don't have.

We have a good system of public and private health care that seems to get the job done cost effectively.

Canadian banks are number one in the world ahead of Denmark, Sweden, and Luxembourg.

We have lots of lakes and forests in Ontario. The rural countryside is usually less than a half hour drive away from any city.

It's a real pleasure to see the trees turn colours in autumn.

On a personal level, I was lucky to have most of my savings in cash when the stockmarket meltdown occurred.

I'm in good health and I'm looking forward to a company pension in the New Year.

I, also, have a van that's paid for and I have more than half of my mortgage paid down.

My wife and I aren't well off, but we're getting by ok.

My Tripod blog is up and running again.

I've won over $200 hundred at poker last month.

I'm still fighting for a worldwide market recovery and justice in the financial sector. Please go through the entries on this page and the links on the right.

We have an election both here and in the U.S. Hopefully, stiff new brooms will sweep away financial corruption and their perpetrators.

When I couldn't get into my blog to make entries, I dusted off my other blog at http://davebarron.blogspot.com/. I used to load up this blog with my favourite YouTube videos, but they were discontinued after awhile.

I've started putting music videos on this blog again and they will remain there for some weeks or months. I wanted something happy and energetic to help people overcome the despair in the U.S. and the world. The latest tune is "The Motown Song" by Rod Stewart and it's a pure joy to hear and see.

Some humans create nothing but misery around them, others fill the world with happiness and hope.

Add Your Blog Blog Topsites

Blogs

Tweets by @DavidCBarron