It isn't the Iraq war. It isn't health insurance. It isn't off shore oil drilling. Pure and simple, it's the mortgage/financial crisis in the U.S.

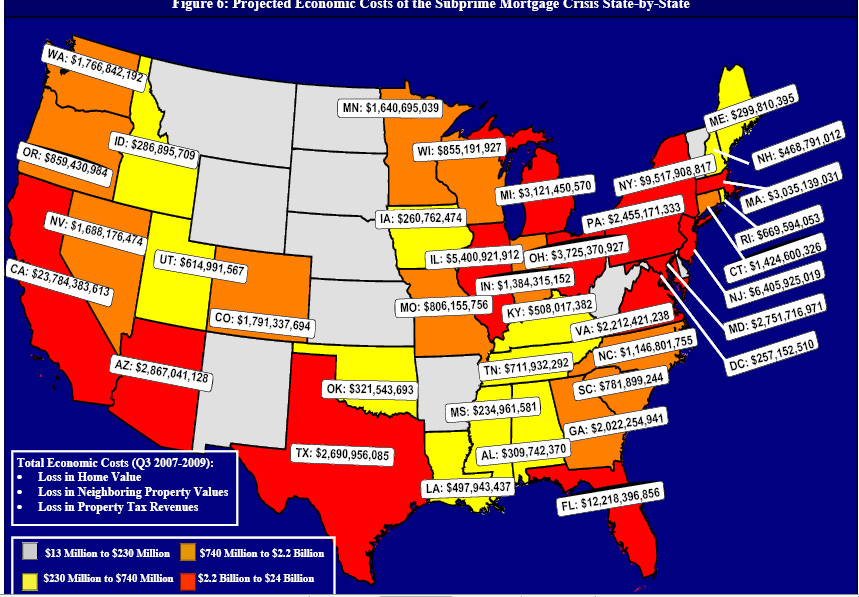

The destruction of personal wealth over the last two years has been enormous: Americans stand to lose $8 trillion (U.S.) in housing wealth, or $110,000 per household.

Take the gigantic U.S. housing agencies Fannie Mae and Freddie Mac, which backstop about half of all U.S. mortgages. The two firms now are essentially illiquid and need a bailout only Washington has the means or will to provide. Their complaisant regulator allowed Fannie and Freddie to underpin a combined $5.4 trillion in mortgages and other liabilities with a laughable $54 million in capital. That 1 per cent reserve ratio compares with government-mandated ratios of 3.5 per cent to 9.5 per cent at commercial banks.

Hank Paulson, the U.S. treasury secretary, boasts of the "bazooka" granted him by Congress to rescue Fannie and Freddie, whose collapse could take down the U.S. financial system.

Some institutions have been fined for their participation in this fraud like Citibank and Merrill Lynch. However, the individuals behind it like the former Citibank CEO, Charles Prince and Merrill Lynch CEO, Stanley O'Neil, got off easy with multi million dollar severance packages.

Shouldn't there be some individual accountability for these actions?

Shouldn't Fannie Mae and Freddie Mac be put to sleep as a private companies and resurrected as one public company like "The U.S. Mortgage and Housing Corporation".

Behind the rhetoric, personalities and ideologies where do Barack Obama and John McCain stand on this issue?

St Johns

St Johns