We all have to live somewhere so why not a detached house that you can buy at a reasonable price which will appreciate in time. For those in the U.S. it looks like there's some great bargains available now.

My wife and I did that in 1996 when we bought our first house (a townhouse) near the bottom of the market. We then sold the townhouse for a "so-so profit" a few years later and bought a detached house in central Brampton for a decent price. Through the next five years, we renovated our house throughly: This includes a new roof, vinyl siding, renovated washrooms(3 of them), renovated bedrooms, new furnance, new A/C, etc.

From the time we purchased it to now, I'd say our house appreciated by $90,000. That's not great, but it's a reasonable rate of return. When we sale our house at some distant future time, we'll get every penny out of it. There are no taxes owing when you sell your principle resident in Canada.

Right now, we want to pay off the mortgage as quickly as possible, so we have more funds for travel, the stock market and fancy renovations like a new kitchen.

A paid off house is equity and freed up cash. Even in the U.S., you could start with a 40 year mortgage, but whittle it down with time by putting extra payments on it.

If you had the money, you could buy two places. One to live in and the other to rent (maybe to some foreigners). Many people in Canada do that as an investment.

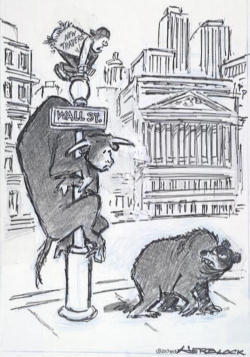

As for the stock markets, there's always a bull market somewhere. Seek and you shall find.

St Johns

St Johns