When I couldn't get into my blog to make entries, I dusted off my other blog at http://davebarron.blogspot.com/. I used to load up this blog with my favourite YouTube videos, but they were discontinued after awhile.

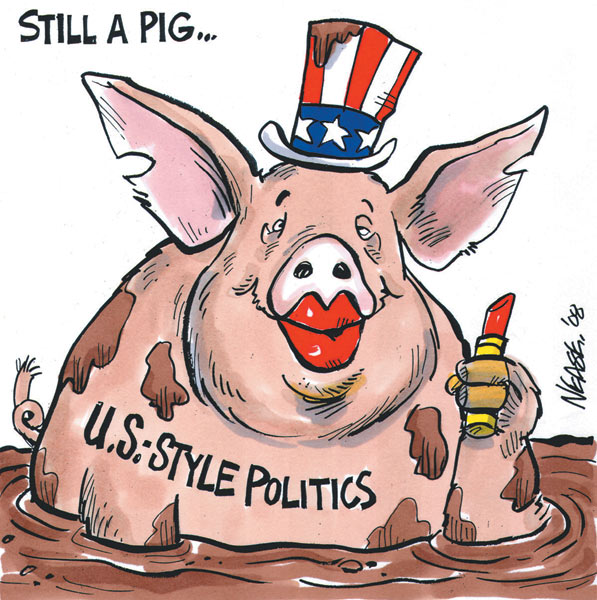

I've started putting music videos on this blog again and they will remain there for some weeks or months. I wanted something happy and energetic to help people overcome the despair in the U.S. and the world. The latest tune is "The Motown Song" by Rod Stewart and it's a pure joy to hear and see.

Some humans create nothing but misery around them, others fill the world with happiness and hope.

St Johns

St Johns